How to turn news sentiment into strategy: A guide for institutional investors

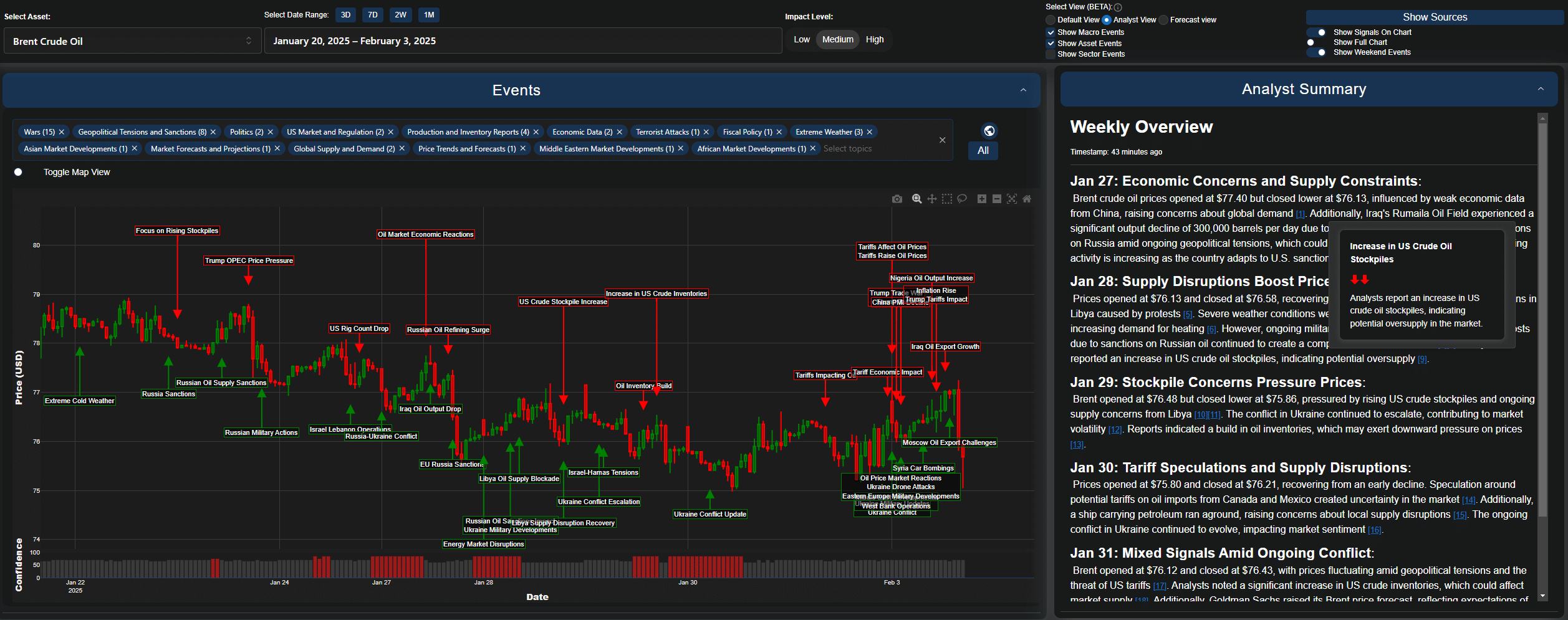

This is a comprehensive guide for institutional investors, quants, and macro strategists on applying news sentiment to trading, risk management, and regime detection, with examples taken from Permutable AI’s market sentiment data. We’re often asked how to apply our market sentiment insights in practice, how to turn the behavioural layer of markets into measurable, actionable … Read more