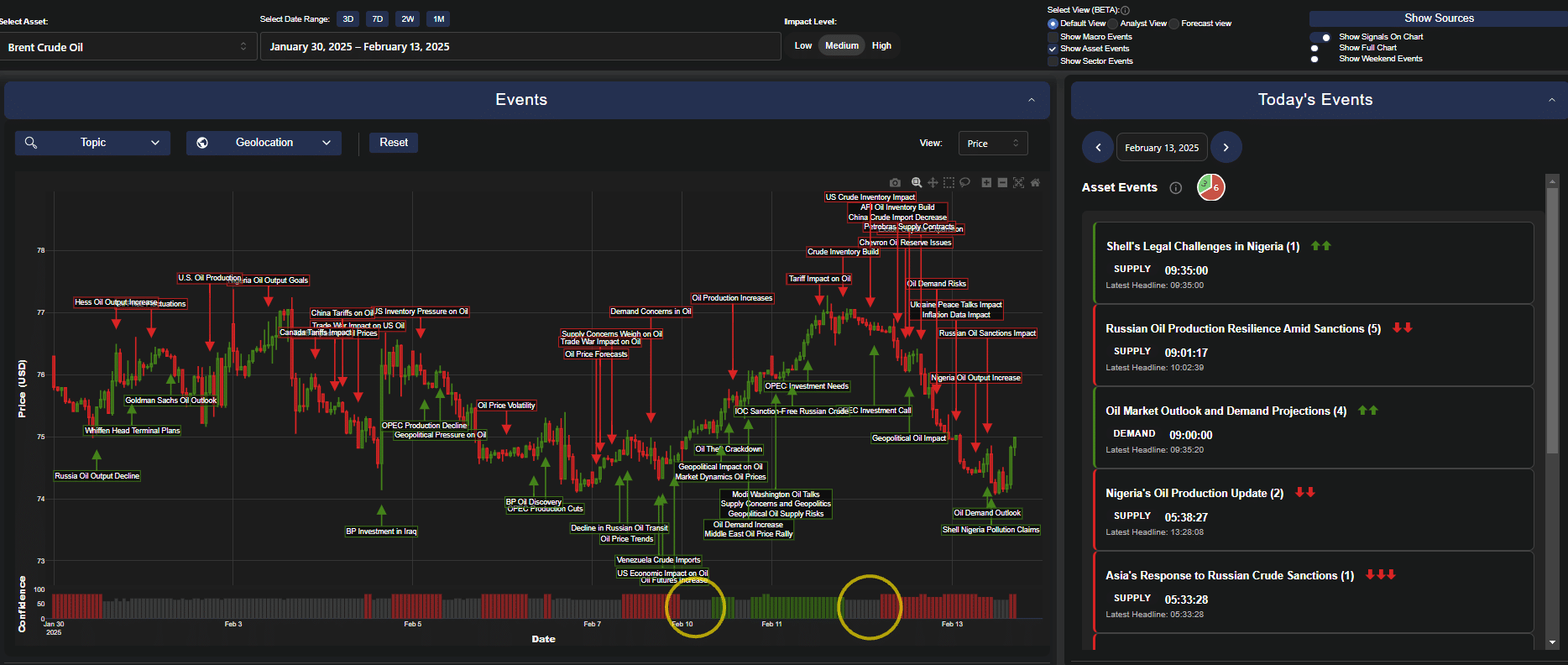

Crude oil price forecast this week: Bearish pressures mount amid supply-demand imbalance

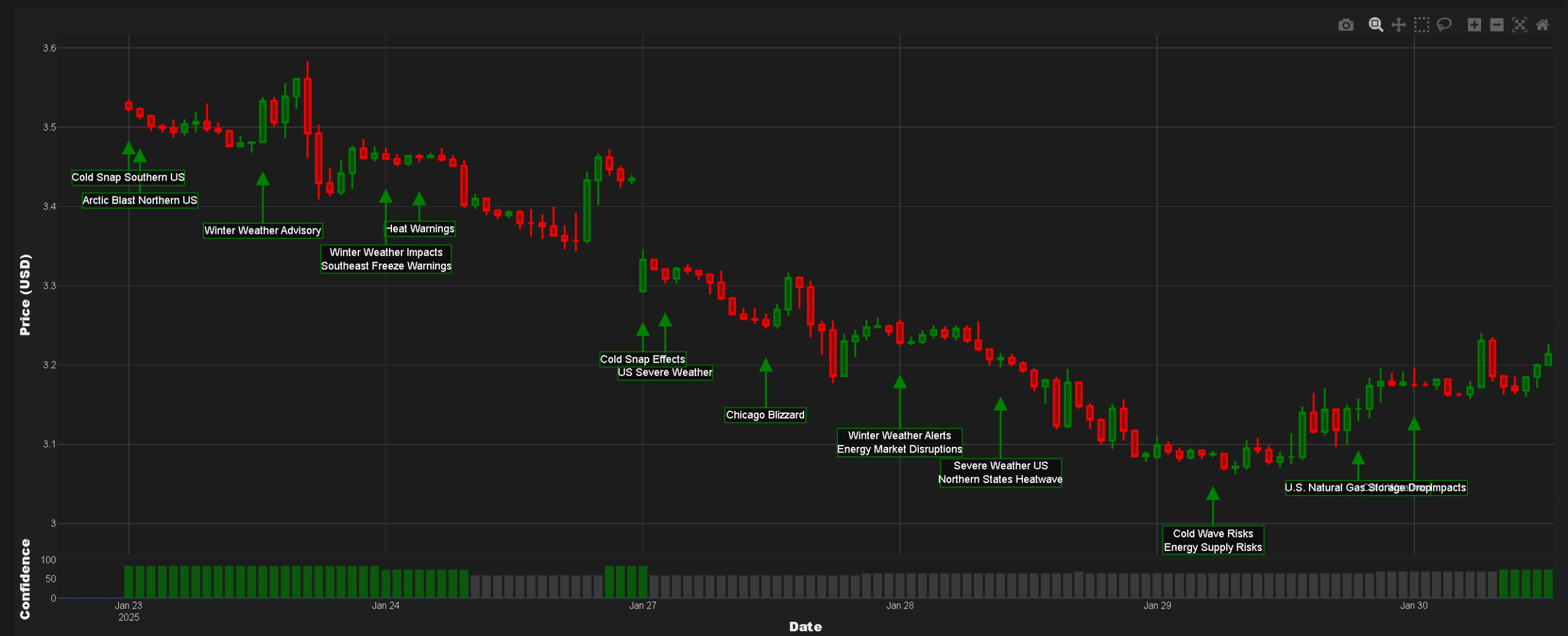

Understanding the complex interplay of factors affecting crude oil price forecast is become increasingly vital for energy traders and investors amid increasing geopolitical and supply-demand tensions. The latest insights surfaced by our Trading Co-Pilot are signalling a consistent bearish trend for Brent crude oil, with prices experiencing notable pressure throughout February, culminating in significant declines … Read more